EU VAT Rules for Polish Businesses Selling Abroad: A Strategic Navigation Guide

Reading time: 12 minutes

Table of Contents

- Introduction: The Polish Business Perspective

- Understanding the EU VAT Landscape

- Key VAT Obligations for Polish Exporters

- OSS and IOSS Systems: Game-Changers for Cross-Border Sales

- Navigating VAT Registration Thresholds

- Special Rules for Digital Services and Products

- Practical Compliance Strategies

- Real-World Case Studies: Polish Success Stories

- Common Mistakes and How to Avoid Them

- Future VAT Changes on the Horizon

- Conclusion: Turning VAT Compliance into Competitive Advantage

- Frequently Asked Questions

Introduction: The Polish Business Perspective

Expanding your Polish business across EU borders? That’s an exciting move—but with it comes the sometimes bewildering world of EU VAT compliance. For many Polish entrepreneurs, VAT rules feel like navigating a labyrinth with regulations changing at every turn.

Let’s be honest: most business owners didn’t launch their ventures because they love tax compliance. You’re focused on growth, product excellence, and market expansion. Yet understanding EU VAT isn’t just about avoiding penalties—it’s about strategic positioning that can actually enhance your competitive edge.

As one Warsaw-based exporter recently told me: “Once we mastered the VAT frameworks across our key markets, we stopped seeing compliance as a cost center and started viewing it as part of our pricing strategy.”

This guide cuts through the complexity to deliver what Polish businesses genuinely need: practical, actionable insights on EU VAT compliance without the unnecessary technical jargon.

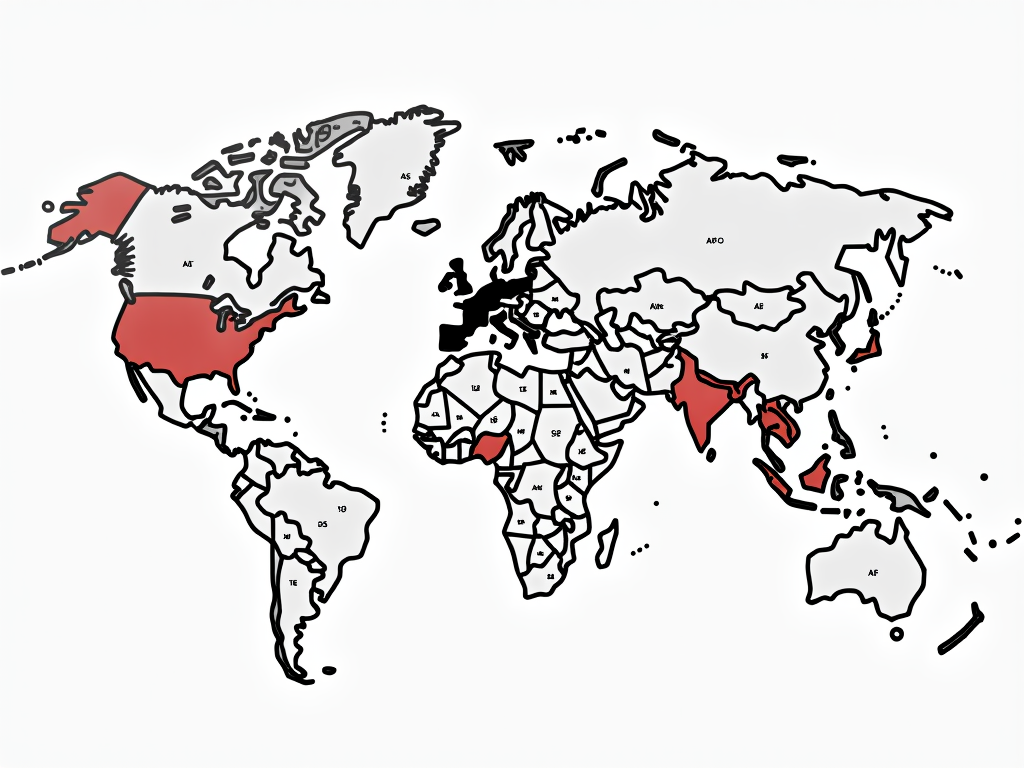

Understanding the EU VAT Landscape

The EU VAT system operates under a framework of shared principles but with country-specific implementations—a fact that creates both opportunities and challenges for Polish businesses.

The Fundamental Principles

At its core, VAT is a consumption tax, meaning it should ultimately be paid where goods are consumed. For Polish businesses, this creates an important distinction:

- B2B transactions: Generally operates under the reverse charge mechanism

- B2C transactions: Usually requires charging VAT at the destination country’s rate

Since Poland joined the EU in 2004, Polish businesses have benefited from the harmonized VAT system while still navigating the nuances of individual member states. According to the European Commission, intra-EU trade for Polish businesses has grown by approximately 15% annually over the past five years, highlighting the importance of getting VAT right.

Poland vs. Other EU Countries: VAT Rate Comparison

| Country | Standard VAT Rate | Reduced Rates | Special Provisions | Impact on Polish Exporters |

|---|---|---|---|---|

| Poland | 23% | 8%, 5%, 0% | Special rates for certain foods and books | Home country baseline |

| Germany | 19% | 7% | Strict documentation requirements | Potential pricing advantage |

| France | 20% | 10%, 5.5%, 2.1% | Complex reduced rate categories | Higher compliance complexity |

| Hungary | 27% | 18%, 5% | Highest standard rate in EU | Pricing challenges for consumer goods |

| Sweden | 25% | 12%, 6% | Digital services taxation framework | Significant rate differential to manage |

This variance creates both strategic opportunities and compliance challenges. A Warsaw-based furniture manufacturer recently shared: “We adjusted our pricing strategy by country based on VAT differentials, which helped us maintain consistent margins while remaining competitive in each market.”

Key VAT Obligations for Polish Exporters

When selling across EU borders, Polish businesses face several distinct VAT obligations that require careful management:

Documentation Requirements

The foundation of VAT compliance lies in meticulous documentation. For Polish businesses, this means:

- Proper VAT invoices that comply with both Polish and destination country requirements

- Transport documentation proving goods have left Poland

- Customer VAT status verification through the VIES system

- Record retention (typically 5 years, but varies by country)

Pro Tip: Create country-specific invoice templates that automatically include all required elements for each destination market. This simple step can save countless hours of administrative corrections.

Reporting Obligations

Beyond proper invoicing, Polish businesses must navigate multiple reporting requirements:

- Standard VAT returns (monthly or quarterly in Poland)

- EC Sales Lists (Intrastat) for B2B transactions

- OSS returns for B2C sales of goods and services

- Country-specific supplementary declarations where applicable

Consider this practical scenario: A Kraków-based clothing retailer selling to both businesses and consumers across the EU initially struggled with compliance. By implementing automated compliance software and establishing a quarterly VAT review process, they reduced administrative time by 70% and eliminated penalty risks.

OSS and IOSS Systems: Game-Changers for Cross-Border Sales

The introduction of the One-Stop Shop (OSS) and Import One-Stop Shop (IOSS) systems in July 2021 fundamentally changed the VAT landscape for Polish businesses selling abroad.

OSS: Simplifying EU Sales

The OSS system allows Polish businesses to register once (in Poland) and declare VAT for B2C sales across all EU countries through a single quarterly return. This represents a significant simplification from the previous requirement to register in each country where sales exceeded the threshold.

For a small Łódź-based cosmetics producer, the OSS system transformed their EU strategy: “Before OSS, we limited sales to certain countries to avoid multiple VAT registrations. Now we can sell anywhere in the EU without worrying about creating new VAT obligations in each market.”

Key benefits include:

- Single quarterly VAT return covering all EU B2C sales

- Payment made to Polish tax authorities, who distribute the funds

- Elimination of multiple VAT registrations

- Streamlined compliance process

IOSS: Streamlining Imports

For Polish businesses selling to EU consumers from outside the EU (for instance, from warehouses in the UK post-Brexit or the US), the IOSS provides similar benefits for goods valued up to €150:

- VAT charged at point of sale rather than at import

- No VAT payment required by the customer upon delivery

- Faster customs clearance and improved customer experience

- Single monthly return for all eligible import sales

A Polish electronics retailer with UK warehouses reported: “IOSS transformed our post-Brexit strategy. Without it, our EU customers were facing unexpected VAT and handling fees on delivery, leading to refusals and returns. IOSS eliminated that problem entirely.”

Navigating VAT Registration Thresholds

Understanding when you need to register for VAT in another EU country is crucial for Polish businesses. The rules changed significantly in July 2021.

Current Distance Selling Threshold

Prior to July 2021, each EU country set its own threshold (typically €35,000 or €100,000) before requiring VAT registration. Now, a simplified system applies:

- €10,000 combined threshold for all B2C cross-border sales of goods and digital services within the EU

- Once exceeded, Polish businesses must either register in each destination country or use the OSS system

- The threshold applies to the total of all EU cross-border B2C sales, not per country

For small Polish enterprises, this represents both a challenge and an opportunity. A handmade jewelry creator from Gdańsk shared: “I hit the combined threshold faster than expected, but OSS registration took less than an hour, and the quarterly returns are straightforward. It’s actually easier than the old system once you adapt.”

Strategic Threshold Management

Polish businesses can approach these thresholds strategically:

- Monitor sales volumes closely against the €10,000 threshold

- Consider registering for OSS preemptively if you expect to exceed it

- For B2B sales, verify and document customer VAT numbers to ensure proper application of the reverse charge mechanism

- Use automated tools to track thresholds and trigger compliance actions

Special Rules for Digital Services and Products

Digital services present unique VAT challenges and opportunities for Polish businesses entering international markets.

Defining Digital Services

For VAT purposes, digital services include:

- Software and software-as-a-service (SaaS)

- E-books, audio, video, and music

- Online courses and webinars

- Website hosting and cloud storage

- Online gaming and gambling services

Polish software companies have become particularly adept at navigating these rules. As the CEO of a Wrocław-based SaaS provider explained: “We’ve implemented automated location verification using three data points: IP address, billing address, and payment method information. This creates a robust evidence trail for VAT purposes.”

Customer Location Verification

A critical aspect of digital services VAT compliance is determining where your customer is located, as this establishes which country’s VAT applies. Polish businesses must:

- Collect and store at least two non-contradictory pieces of evidence of customer location

- Implement technical solutions to verify location

- Apply the correct VAT rate based on this location

- Maintain records for potential tax authority audits

While this sounds complex, automation has made compliance more manageable. Most major e-commerce and payment platforms now handle much of this verification automatically, reducing the burden on Polish businesses.

Practical Compliance Strategies

Moving beyond theory, here are practical compliance strategies that have proven successful for Polish businesses expanding across the EU:

Technology Solutions

Investing in the right technology can transform VAT compliance from a burden to a routine process:

- VAT calculation engines integrated with your e-commerce platform

- Automated report generation for OSS and domestic returns

- Customer location verification tools for digital services

- VIES validation APIs for verifying business customer VAT numbers

A medium-sized Polish online retailer shared: “We initially tried to handle VAT manually using spreadsheets. Switching to an automated solution reduced our compliance costs by 65% and eliminated errors that had previously resulted in penalties.”

Documentation Systems

Establishing robust documentation systems protects Polish businesses during potential audits:

- Create a VAT compliance calendar with all filing deadlines

- Implement a document retention system that meets all EU requirements

- Develop country-specific invoice templates with all required fields

- Maintain evidence of goods movements for zero-rating exports

- Document customer status verification for all B2B transactions

Pro Tip: Conduct quarterly internal VAT audits to identify and address compliance issues before they become problems during an official audit.

Real-World Case Studies: Polish Success Stories

Case Study 1: E-commerce Furniture Retailer

A Warsaw-based furniture manufacturer selling custom pieces across the EU initially struggled with VAT compliance, facing penalties in multiple countries due to missed registrations and incorrect VAT applications.

Their solution included:

- Early OSS registration to consolidate all B2C reporting

- Implementation of country-specific pricing that factored in local VAT rates

- Restructuring delivery processes to clearly document cross-border movements

- Quarterly VAT review with external specialists

The result: A 15% reduction in administrative costs, elimination of compliance penalties, and the ability to enter 5 new EU markets that they had previously avoided due to VAT complexities.

Case Study 2: Software Developer Transformation

A Kraków-based software company offering subscription services faced challenges determining the correct VAT treatment for corporate versus individual customers across different EU countries.

Their approach:

- Implemented robust customer verification during the signup process

- Created automated VAT determination based on customer status and location

- Utilized OSS for all B2C transactions

- Developed clear documentation for reverse-charge B2B sales

The outcome: Streamlined compliance allowed them to focus on growth, resulting in expansion to 18 EU countries without additional VAT administration costs. Their finance director noted: “VAT compliance went from being a growth blocker to an essentially invisible background process.”

Common Mistakes and How to Avoid Them

Even experienced Polish businesses make VAT errors when expanding internationally. Here are the most common pitfalls and how to avoid them:

Mistake 1: Ignoring Registration Thresholds

Many Polish businesses don’t monitor their EU sales closely enough, suddenly realizing they’ve exceeded thresholds and have been non-compliant for months.

Solution: Implement automatic threshold monitoring in your accounting system with alerts at 80% of threshold values. Consider registering for OSS preemptively if you expect growth.

Mistake 2: Incorrect VAT Rate Application

With over 75 different VAT rates across the EU, Polish businesses often apply the wrong rates, especially for products that qualify for reduced rates in some countries but not others.

Solution: Invest in a VAT calculation engine that automatically applies the correct rate based on product category and destination. Review rate determinations quarterly as rates and classifications change.

Mistake 3: Insufficient Evidence for Zero-Rating

When Polish businesses zero-rate B2B sales to VAT-registered customers in other EU countries, they sometimes fail to maintain adequate proof, leading to assessments during audits.

Solution: Create a mandatory checklist for all zero-rated sales that includes VIES validation, transport documentation, and signed customer declarations.

Future VAT Changes on the Horizon

Polish businesses should prepare for upcoming VAT changes that will impact cross-border sales:

- VAT in the Digital Age (ViDA) initiative – Expected to introduce real-time digital reporting requirements across the EU by 2025

- E-invoicing mandates – Already required in Italy and expanding to other EU countries

- Marketplace deemed supplier rules – Expanding to cover more transaction types

- Green VAT rates – Reduced rates for environmentally friendly products being introduced in several countries

A forward-thinking Polish business consultant advises: “Don’t just comply with today’s rules. Build flexible systems that can adapt to the digital reporting requirements that are inevitably coming. The businesses that prepare now will have a significant advantage.”

Conclusion: Turning VAT Compliance into Competitive Advantage

For Polish businesses selling abroad, EU VAT compliance doesn’t have to be merely a cost center or administrative burden. When approached strategically, it can become a competitive advantage.

The businesses that thrive in cross-border trade are those that:

- Invest in appropriate technology and expertise early

- Build VAT considerations into their pricing and market entry strategies

- Use OSS and IOSS systems to simplify compliance

- Stay ahead of regulatory changes rather than reacting to them

- View compliance as an enabler of growth rather than an obstacle

As one successful Polish exporter put it: “Once we mastered EU VAT, we realized our competitors were still struggling with it. We could enter markets more confidently, price more precisely, and create a better customer experience without surprise tax charges. What started as a compliance exercise became a genuine competitive edge.”

With the strategies outlined in this guide, your Polish business can navigate the EU VAT landscape with confidence, focus on growth rather than compliance anxiety, and turn tax knowledge into market advantage.

Frequently Asked Questions

How does Brexit affect Polish businesses selling to UK customers?

Since Brexit, the UK is considered a non-EU country for VAT purposes. This means Polish businesses must treat sales to the UK as exports, which are generally zero-rated for Polish VAT. However, for B2C sales, you may need to register for UK VAT if you exceed the £85,000 threshold. For low-value goods (under £135), you must register for UK VAT regardless of threshold. Many Polish businesses use the UK’s version of IOSS, called the Overseas Seller Registration scheme, to simplify compliance. Additionally, you’ll need to complete export declarations when shipping goods to the UK and your customers may face import VAT and customs duties.

Can my Polish business use OSS if we sell both physical and digital products?

Yes, the OSS system covers both physical goods and digital services for B2C sales across EU borders. This is one of the major advantages of the system introduced in July 2021. Previously, there were separate systems for goods and digital services, but now Polish businesses can report all cross-border B2C sales through a single quarterly OSS return. This applies to physical goods shipped from Poland to consumers in other EU countries and to digital services provided to non-business customers throughout the EU. The only exception is for imported goods valued under €150, which would use the IOSS system instead if shipped from outside the EU.

What happens if my Polish company exceeds the €10,000 threshold mid-year?

If your Polish business exceeds the €10,000 threshold for cross-border B2C sales within the EU during the year, you must begin applying the destination country’s VAT rates from the very next transaction after exceeding the threshold. You should immediately register for the OSS system (which can be done through the Polish tax portal) or register for VAT in each destination country. The registration process for OSS typically takes 1-2 weeks. Any sales made between exceeding the threshold and completing registration still require destination country VAT to be applied, and these will need to be included in your first OSS return. There’s no grace period for compliance, so monitoring your thresholds closely is essential to avoid unexpected tax liabilities.